The edtech funding slope continues to go down steeper with the number of deals reducing and fewer funds seeing the edtech industry’s side. Indian startup investments have witnessed a steep decline in Q1 2023 compared to Q1 2022. The “Tracxn Geo Quarterly Report: India Tech – Q1 2023” reports that Indian startups raised a total of $2.8 billion during Q1’23, which reflects a 75 per cent decline from the $11.9 billion raised in Q1 2022. The primary reason for the decrease in funding could be due to the rise in interest rates and inflation that has significantly impacted investments, the report adds.

Finance, Retail, and Enterprise Applications were the three industries that received the most funding in Q1’23. Although FinTech funding increased by to $1.2 billion in Q1’23 marking a substantial increase from the last quarter of 2022. However, this figure was 55 per cent lower than the funds raised in Q1 2022, indicating a slowdown in the growth of the industry. In addition, no new Indian unicorns were born during Q1’23, in contrast to Q1’22, which witnessed the growth of 14 unicorns.

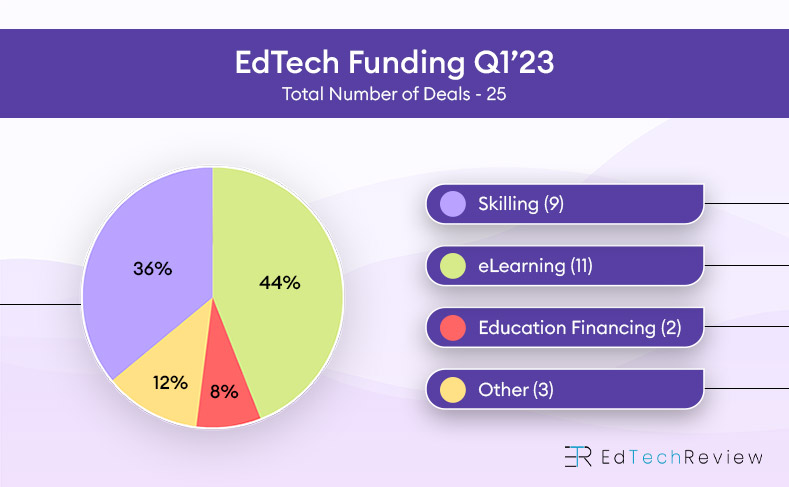

As per our data, the edtech sector has been pushed into a tight corner with a total of 25 deals in Q1 2023 totalling to ₹16387.6 million ($ 200 million). The top three segments under the edtech umbrella are eLearning, Skilling and Education Financing. The total amount dumped in these three sectors stands at ₹15532.2 million ($ 189 million). Bengaluru has the maximum deals to its credit. And despite having only two deals, education financing has bagged the maximum amount of funding which is over half of the total amount dumped into the Indian edtech industry at 52 per cent of the entire share.

Current Market Focus

The current edtech funding winter is aligned with our predictions for the year 2023. In our article, Where is the EdTech Sector Headed: 2023 Trends, Predictions & Founder Opinions, we predicted Skilling as a critical focus for edtech players aiming for skill development on all levels. The funding traction for Q1 2023 in India has marked 9 funding deals in the skilling sector out of 25 deals in total.

The skilling sector has gained 23 per cent of the total sum dumped into the edtech industry. One of the primary reasons for skilling companies to flourish is the NEP 2020. The policy focuses on creating a holistic multidisciplinary system that can help students develop critical thinking, creativity and problem-solving skills with a focus on STEM education. Since NEP encourages experiential learning, the policy has envisioned introducing STEM education (focusing on tech skills) from the early education stages (at age 6). The policy also recommends integrating coding and mathematical thinking from 6th grade (age 11).

The Union budget 2023 also emphasises the growth of the edtech sector. For instance, the launch of “Pradhan Mantri Kaushal Vikas Yojana 4.0” (PMKVY) is an attempt to bridge the skill gap and equip lakhs of youth with industry 4.0 skills such as AI, coding, soft skills, and robotics., through new-age courses, among other skilling and education-focused programmes.

Next is the eLearning segment, which has 11 deals to its credit, the maximum number of deals in a given segment. As per the India eLearning report by IMARC, the India e-learning market size touched US$ 6.4 billion in 2022. IMARC Group expects the market to reach US$ 14.1 billion by 2028, with an estimated growth rate (CAGR) of 13.7% from 2023 to 2028.

We believe the reason is the government’s focus on NEP 2020 and the Union Budget 2023. NEP 2020 outlines the importance of digital and online learning and the growth in adopting eLearning solutions across all education levels. Also, to promote skill education from an early age, CBSE’s new curriculum has announced AI education right from the 6th standard. Given the focus on tech-related education by the government, EdTechs are clearly focusing on services around NEP 2020 and PMKVY 4.0; therefore, we see an increase in eLearning funding.

At last, Education Financing is the last notable segment, with only two deals and over 50 per cent of the edtech funding for Q1 2023 at ₹8560 million.

A glimpse at the edtech fundings India Q1 2023:

- Total No. of Deals: 25

- Total Amount of Funding: ₹16387.6M

Top 3 Segment

- eLearning: 11 deal

- Skilling: 9 deals

- Education Financing: 2 deals

Top 3 Deals by Value

- Avanse Financial Services: ₹8000M

- NxtWave: ₹2706M

- LEAD: ₹1600M

Regions with the highest number of deals and the total sum

- Bengaluru, Karnataka: 8 deals with popular names like BlueLearn and Moat School with a total funding amount of ₹2496 million.

- Delhi-NCR: 7 deals with popular names like AdmitKard and GenLeap with a total funding amount of ₹876.6 million.

- Hyderabad, Telangana: 3 deals with one of the top-funded deals, i.e., NxtWave, with a total funding amount of ₹2995 million.

To help you better visualise the Indian EdTech funding scene, we have compiled a list of Indian EdTechs funded in Q1 2023. The list comprises all details of the funding round in the Indian edtech sector for Q1 2023.